Variable amount

Here's your guide to setting up and sending Variable Amount invoices in Kivra.

Sending Variable amount invoices

*Note! Don't use Variable Amount if you want the payer to choose from two or more fixed amounts. For that, use Multiple payment options. *

Open API reference/send content in new tab.

Note! These instructions apply only for sending invoices in Sweden.

Defining content as a Variable amount invoice requires correct metadata:

Step 1 – add your company's SSN or VAT number

SSN or VAT numbers are required for all content in Kivra.

Step 2 – add subject/title

This subject/title will be visible in the Recipient’s Inbox.

Note! Don’t include any personal information here, such as the recipient's name or SSN in the subject/title.

Step 3 – set type

By setting the type, you determine what type of content you're sending.

Note! It’s important to set the correct type. If not, the notification and content interaction might not be correct.

These are the available types for invoices:

invoice

A “standard” invoice

Notifications and emails for invoice:

- Alert: immediately. Push notification and email.

- First reminder: 2 bankdays + 2 days before due_date. Push notification.

- Second reminder: 1 bankday + 2 days before due_date. Email.

invoice.reminder

A reminder for an unpaid invoice

Notifications and emails for invoice.reminder:

- Alert: immediately. Push notification and email.

- First reminder: 2 bankdays + 2 days before due_date. Push notification.

- Second reminder: 1 bankday + 2 days before due_date. Email.

invoice.debtcollection

A special type of content that is used by debt collection agencies to send debt collection claims (sv: inkassokrav).

Notifications and emails for invoice.debtcollection:

- Alert: immediately. Push notification and email.

- First reminder: 2 bankdays + 2 days before due_date. Push notification.

- Second reminder: 1 bankday + 2 days before due_date. Email.

invoice.debtcampaign

A special type of invoice that is used in long-term monitoring of debt collection. This type supports long due dates, and can be used when the debtor doesn’t have sufficient creditworthiness to meet the claims.

Notifications and emails for invoice.debtcampaign:

- Alert: immediately. Push notification and email.

- First reminder: After 7 days. Push notification.

- Second reminder: After 7 + 35 days. Push notification and email.

invoice.renewal

This is not an actual invoice, but an offer. As such, it’s voluntary to pay for the recipient. We recommend using this type for prolonging an insurance, a subscription, or similar.

Notifications and emails for invoice.renewal:

- Alert: immediately. Push notification and email.

- First reminder: 2 bankdays + 2 days before due_date. Push notification.

- Second reminder: 1 bankday + 2 days before due_date. Email.

Step 4 – add file and details

Content in Kivra always contains a PDF file. If you’re sending responsive content, you will also need to provide a HTML document. In that case, the PDF will serve as backup if the user wants to access the original content.

The following details are required for your file:

name

the filename that is shown alongside the File in the Kivra GUI.

data

base64-encoded data. This is the data for the actual PDF file.

content_type

the IANA media type corresponding to the file. In the case of Variable amount invoices, this will most likely be "application/pdf".

Step 5 – add context

"Context" sets the payment details for your invoice. In order to use Variable Amount, you must choose the “Payment” option.

The following details are required for Variable Amount invoices:

Payable

Set to "true".

Note! If this is set to 'false' the content will not be payable through Kivra.

Currency

Due date

total_owed

The total amount, and the maximum amount that can be paid.

Note! Since payable=true, total_owed must be 1 SEK or more. For KYC/AML reasons, total_owed should not exceed 150 000 SEK.

Type

Type of format for the reference. Must be consistent with “Reference” (below). There are 2 alternatives:

"SE_OCR" – must fulfill the requirements for OCR.

"TENANT_REF" – a reference of your choice.

Account

The receiving account number.

Reference

The reference used for paying. Must be consistent with “Type” (above).

Variable amount

Change from "false" (default) to "true".

min_amount

This is where you set the minimum amount that should be paid in your Variable amount invoice. This field isn’t required. If empty, the invoice will have a minimum amount of 1 SEK.

Note! “min_amount” is a soft limit. If the recipient pays a lower amount, they will get a warning message, but their payment will still be processed.

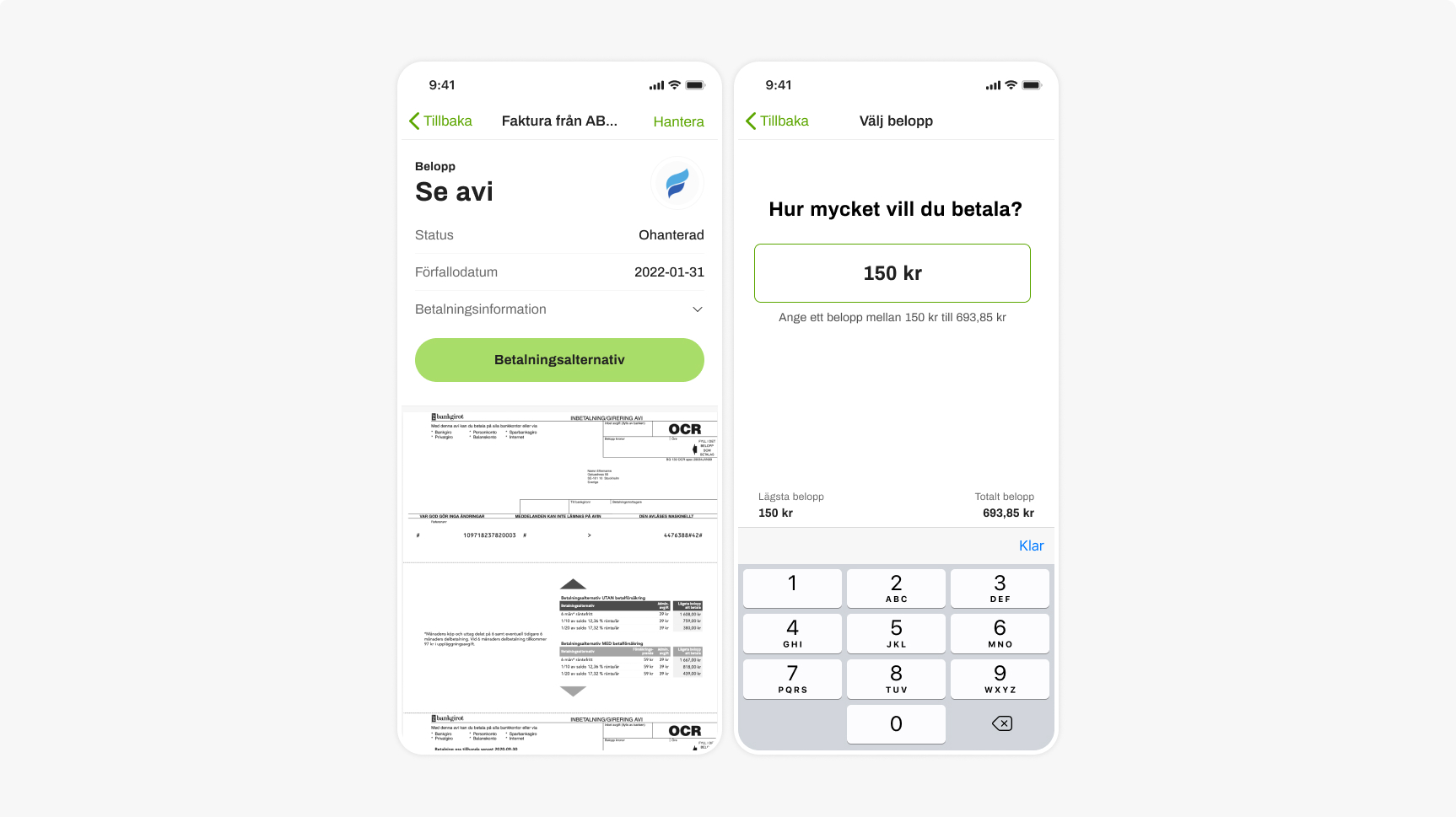

The Variable amount invoice experience for the recipient

Variable Amount invoices let the recipient choose the amount they want to pay, within a range that you define. Suitable for credit card bills and donations to charity organizations and similar. Here's what the Variable Amount invoice experience is like.

1 – notifications and email

As soon as the invoice is registered in Kivra, the recipient receives a push notification and an email, alerting them of the invoice. If the recipient doesn’t pay the invoice in Kivra, or doesn’t mark it as “paid” in Kivra, they will eventually be reminded with more push notifications and emails. This significantly reduces the risk of unpaid invoices.

Note! Notifications and emails are tailored to fit the specific type that you chose in step 3 above.

2 – opening the invoice

The recipient opens the invoice in their Kivra app. When paying the invoice, they type the exact amount they want to pay, within the range that you have defined.

An invoice with a variable amount

An invoice with a variable amount

3 – paying the invoice

The recipient chooses which payment method to use when paying:

- From their bank account. This option is always available. The user selects which bank account to pay from and approves the payment with BankID.

- Swish. This option is available if Swish is enabled for your company. See documentation on setting up Swish payments.

- The recipient can also pay the invoice outside of Kivra, through their usual bank app or similar.

And that's it!